28+ Mortgage loan interest rates

Conforming fifteen-year FRMs rose. The average FHA 203b loan was a tenth of a percent higher at 328.

Cost Tracker Templates 15 Free Ms Docs Xlsx Pdf Downloadable Resume Template Templates Excel Spreadsheets Templates

Interest rates and annual percentage rates APR are two different ways of expressing the fees a borrower incurs when taking out a mortgage.

. A 228 adjustable-rate mortgage 228 ARM maintains a low fixed interest rate for a two-year period after which the rate floats semiannually. Another rise in mortgage rate happened this week pushing them to the highest levels of this cycle so far. 1 Comparison rates are based on a secured loan of 150000 over a term of 25 years.

Mortgage rates on 51 ARMs are often lower than rates on 30-year fixed loans. The average interest rate for a 30-year mortgage has climbed above 6 a level unseen since 2008 reaching 612 this week. Free pre-qualification for Texas Veterans.

For instance in February 2010 the national average mortgage rate for a 30 year fixed rate loan was at 4750 percent 5016 APR. When the rate starts adjusting after the fixed period ends it could go up or down. After hitting record lows in 2021 mortgage rates have risen sharply in 2022.

6 2022 1128 am. The average mortgage interest rates increased for all three loan types week over week 30-year fixed rates went up 566 to 589 as did 15-year fixed rates 498 to 516 and 51 ARM rates 451 to 464. To find the best mortgage rates we analyzed all 30-year loans from the biggest lenders in 2021 the most recent data available.

Interest rates will have an impact on your mortgage term and how much you will repay each month so its a good idea to get familiar with them. Mortgage rates vary depending upon the down payment of the consumer their credit score and the type of loan that will be acquired by the consumer. The initial interest rate of an adjustable-rate mortgage is typically lower than a fixed-rate loan and.

Have a browse through our. 2 Years fixed rate until 3103. The number of mortgage applications decreased 08 as reported by Mortgage Bankers.

2 Years fixed rate. Current VA Mortgage Rates. Rates terms and fees as of 9142022 1015 AM Eastern Daylight Time and subject to change without notice.

This comparison rate applies only to the example or examples givenDifferent amounts and terms will result in different comparison rates. VA interest rates are not set by the Department of Veterans Affairs the VA but by each VA approved lender individually. The many different types of mortgage loans available today biweekly payment plans how to shop for a mortgage steps in the mortgage application process loan closing activities and closing costs the refinance process second mortgages option ARM loans 15-year fixed loans 100 financing interest-only loans 228 or 327 ARMs hybrid.

In order to get a mortgage loan that works. The lender provides funds on your behalf secured by a lien on your home and you agree to repay the loan plus interest. The higher rate environment means housing affordability already a challenge in.

60 Maximum Loan to Value LTV Mortgage Initial interest rate Followed by a Variable Rate currently Initial interest rate period Overall cost for comparison APRC Booking fee Annual overpayment allowance Cashback Maximum loan amount subject to LTV and Lending Policy 2 Year Fixed Standard Buy To Let. 1110 28 May 21. What is the difference between interest rate and APR on a mortgage.

Costs such as redraw fees or early repayment fees and cost savings such as fee waivers are not included in the comparison rate but may influence. On average personal loan interest rates range from 10 to 28 but this varies based on inflation the current demand for credit and other economic. Learn more mortgage loan rates and see payment details.

There are two main choices available fixed or variable rate. FHA loans can work for you. Associated Bank offers a variety of mortgage products.

Interest rate relates to the cost of borrowing stated as a percentage on the principal amount of a mortgage. That could change after the Federal Reserve raises its interest rate as. With an adjustable-rate mortgage youll enjoy lower initial interest rates and receive rate protection up to a full 10 years.

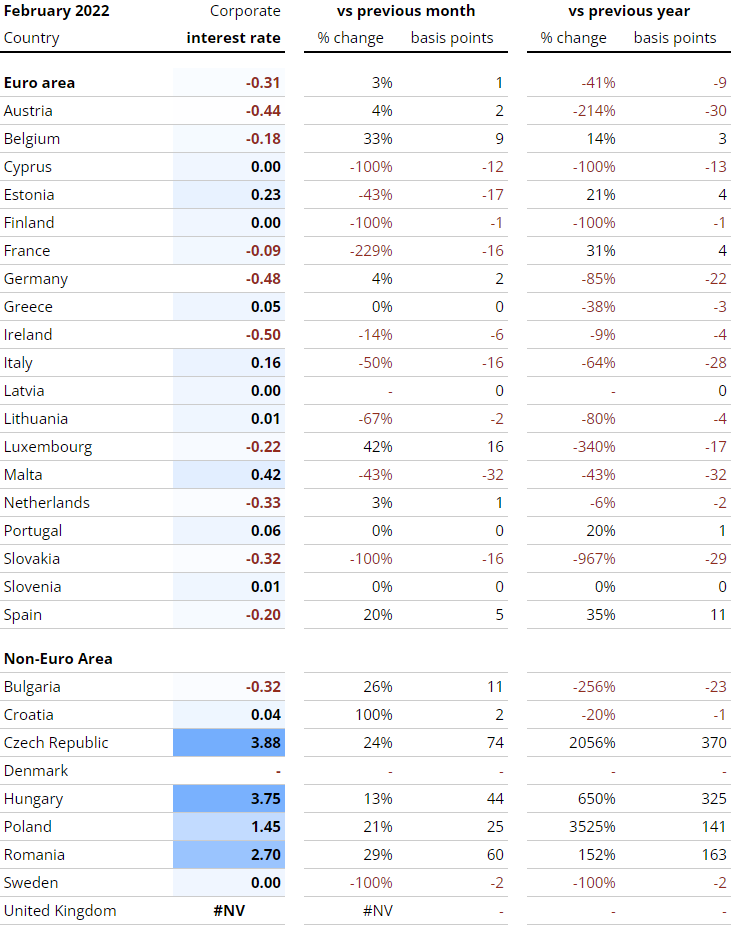

The fixed and variable rates shown below are applicable from 24 th February 2022. Today a few important mortgage rates moved up. Todays Mortgage Rates.

Need a mortgage with less stringent credit requirements and affordable down payments. Get current Texas Veteran VA Mortgage Loan interest rates from an approved Texas Vet VA Lender. Home Loan Interest Rates.

Current mortgage rates in California. FHA mortgage rates can be higher or lower than conventional loan rates depending on the FHA-sponsored lender. Freddie Mac reported today that the average offered interest rate for a conforming 30-year fixed-rate mortgage increased another 23 basis points 023 rising to 589 as high as they were back in late November 2008.

Weekly Rate Recap Mortgage Rates Today. 60 Maximum Loan to Value LTV Mortgage Initial interest rate Followed by a Variable Rate currently Initial interest rate period Overall cost for comparison APRC Booking fee Annual overpayment allowance Cashback Maximum loan amount subject to LTV and Lending Policy 2 Year Fixed Fee Saver. Mortgage Rates.

Wed Sep 14 2022 LOGIN Subscribe for 1. An adjustable-rate mortgage ARM is a type of mortgage in which the interest rate applied on the outstanding balance varies throughout the life of the loan. 12 The companies with the lowest mortgage rates on average are.

As interest rates surge its getting more expensive to buy a house. The largest interest rate hike in 28 years three-quarters of a percentage point was announced by the Federal Reserve as it tries to rein in surging prices. When rates go up ARM borrowers can.

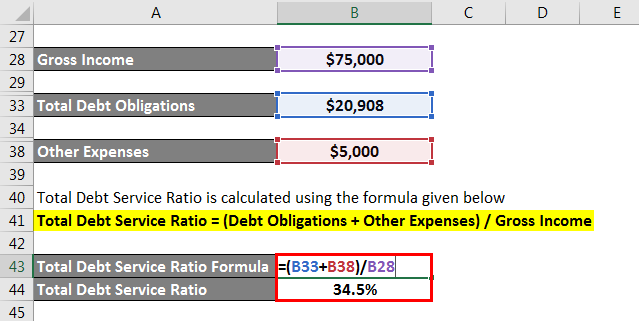

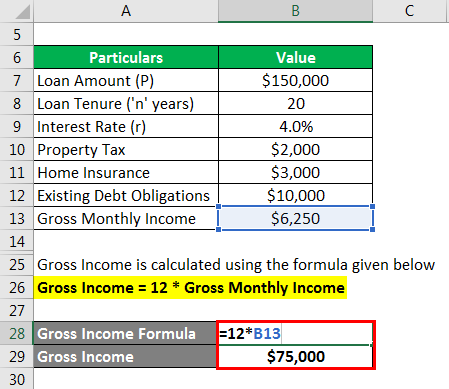

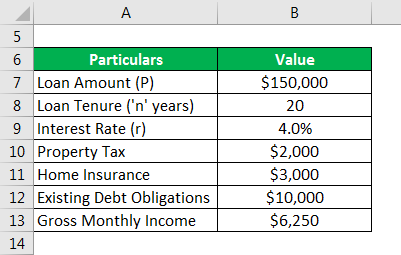

Total Debt Service Ratio Explanation And Examples With Excel Template

Sample Letter Of Explanation For Mortgage Refinance Luxury Cash Out Letter Template Konusu Lettering Letter Templates Business Letter Template

Purchase Requisition Form Templates 10 Free Xlsx Doc Pdf Formats College Application Essay Templates Excel Templates

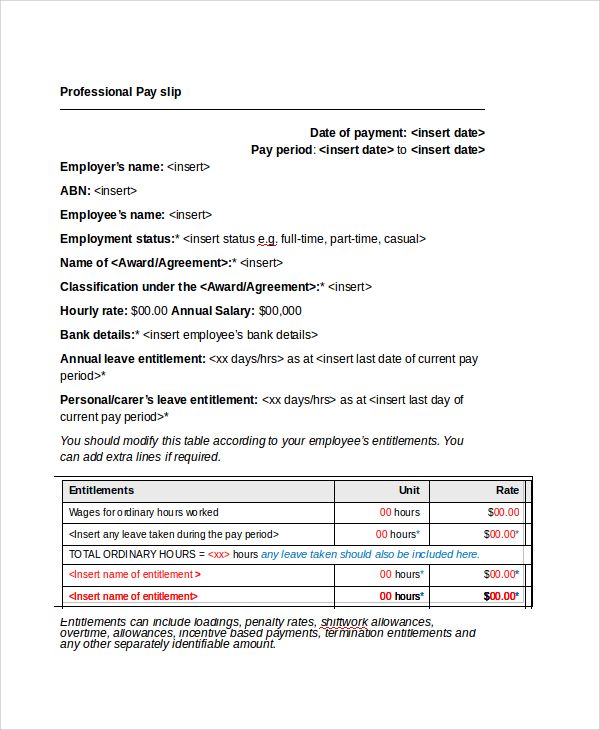

Payslip Templates 28 Free Printable Excel Word Formats Templates Excel Templates Words

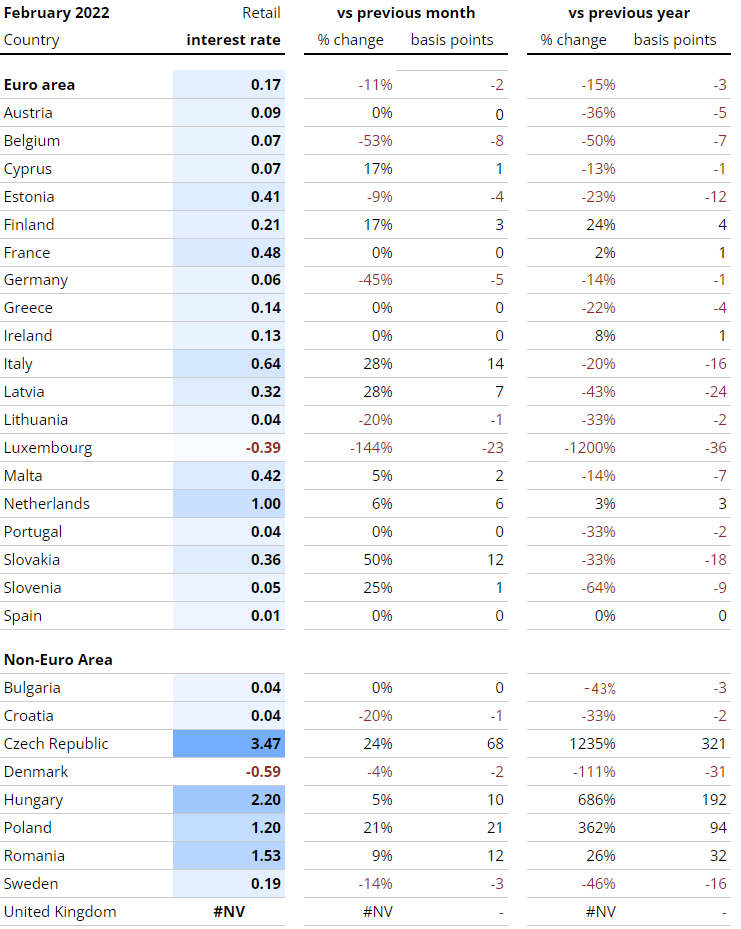

Interest Rates Explained By Raisin

Tables To Calculate Loan Amortization Schedule Free Business Templates

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Calculator

Tables To Calculate Loan Amortization Schedule Free Business Templates

Total Debt Service Ratio Explanation And Examples With Excel Template

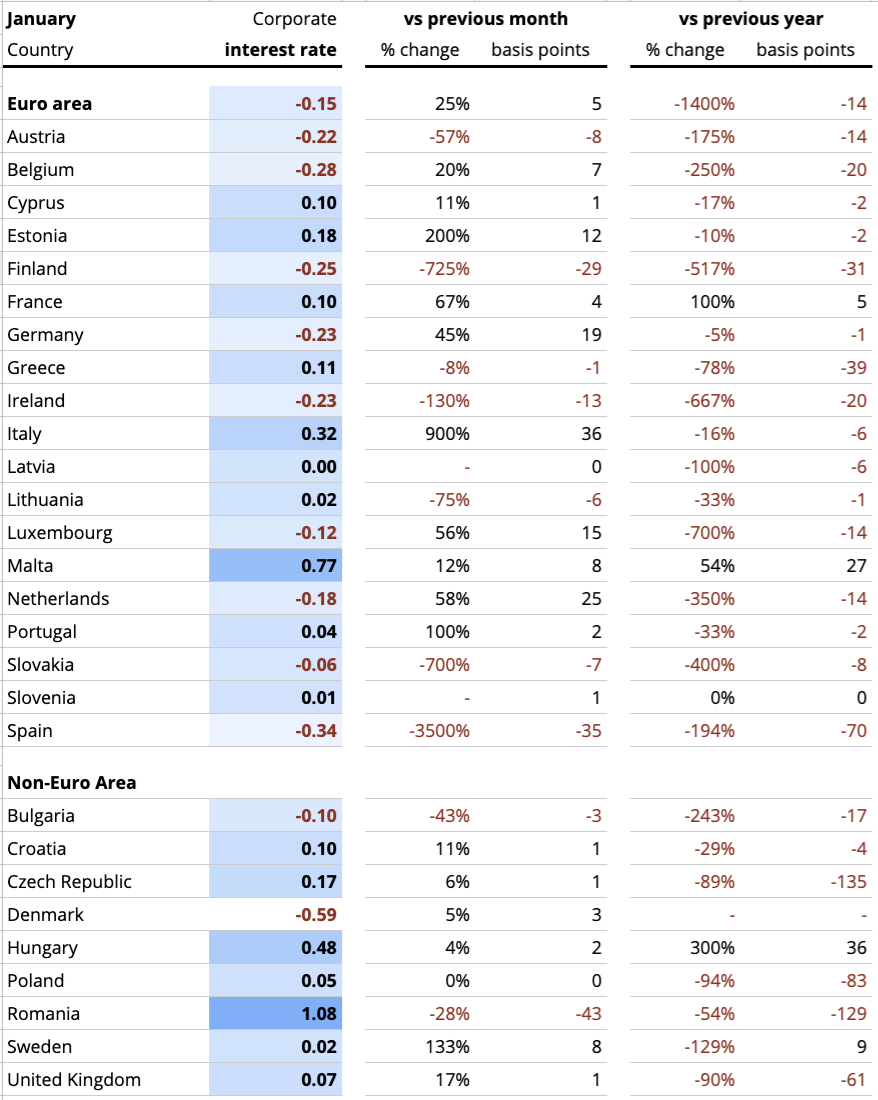

Ex 99 1

Payslip Templates 28 Free Printable Excel Word Formats Templates Excel Templates Repayment

Land Lord Rental Property Rental Property Management Free Property Rental Property

Interest Rates Explained By Raisin

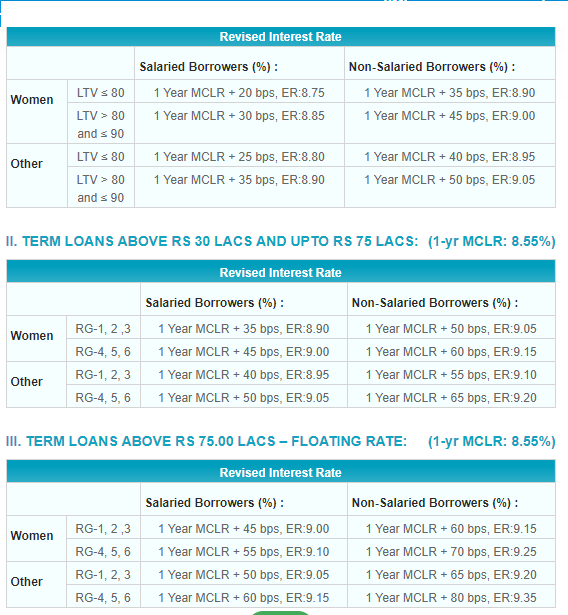

Sbi Home Loan Calculator 2019 Factory Sale 58 Off Rikk Hi Is

Interest Rates Explained By Raisin

Pin On T I P S I D E A S

Total Debt Service Ratio Explanation And Examples With Excel Template